12 Proven Trading Strategies

Smart Traders Use to Gain Market Edge

A REAL TRADER'S PLAYBOOK FOR SUCCESS

One of our experienced MarketLens users, @micro_burry, recently shared their comprehensive approach to using broker data for trading success. Their strategies have proven so valuable that we wanted to share them with our community (with their generous permission and some adaptations for clarity).

These aren't theoretical concepts—they're battle-tested strategies that have helped real traders identify opportunities, avoid costly mistakes, and consistently stay ahead of market movements.

THE FOUNDATION: UNDERSTANDING BROKER DATA INTELLIGENCE

Broker data reveals the hidden mechanics of the market—who is buying and selling, when they're making moves, and why certain patterns emerge. This intelligence allows you to:

Follow the Smart Money

Instead of getting caught in retail traps

Identify Opportunities

Before they become obvious to the broader market

Protect Your Capital

By spotting warning signs early

Scale Your Analysis

Across multiple sectors without deep expertise in each

12 STRATEGIES THAT GIVE YOU THE EDGE

Avoid dilution disasters before they happen

Monitor when brokers involved in previous capital raises start heavy selling. This early warning system can save you from getting caught in discounted placements that dilute your holdings. Professional traders often exit before retail investors even know what's coming.

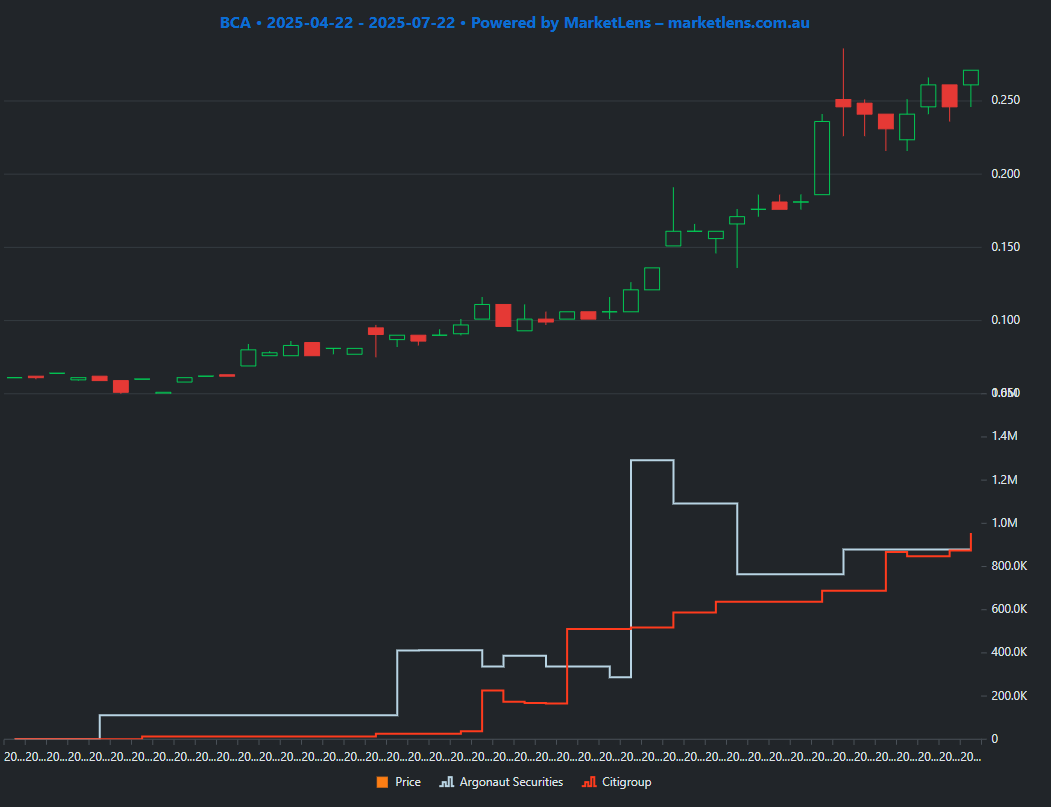

Filter false breakouts with institutional validation

Use professional broker participation to confirm genuine breakouts from key resistance levels. This helps distinguish between false breakouts that quickly reverse and legitimate momentum shifts.

Protect capital when prices collapse

When prices gap down on news, avoid the temptation to catch falling knives. Instead, wait for broker data to show who's buying at the bottom. If it's only retail investors, the decline likely continues.

Spot the professionals taking profits before bad news

Track major players' selling activity before key announcements like drilling results or trial data. When institutions quietly exit before catalysts, it's often a red flag that insiders know something the market doesn't.

Ride alongside informed money

Identify when smart money is quietly accumulating before major catalysts. This strategy helps you position alongside informed investors who are betting on positive outcomes.

Decode the "leaky ship" signals

In small caps, certain brokers are consistently used by insiders. By tracking their significant purchases, you can spot companies where important announcements may be imminent—essentially identifying information leaks before they become public.

Mirror the moves of proven winners

Track brokers with exceptional track records in specific sectors. Some brokers consistently outperform in picking winning opportunities, especially in small-cap resource sectors.

Catch sector rotations early

Use broker flow data to identify where professional money is rotating—whether it's into lithium, uranium, gold, or emerging sectors. This gives you early exposure to thematic trends before they become mainstream.

Position for macroeconomic shifts

For larger caps, broker data reveals shifts between defensive and growth sectors based on economic cycles. Spot early moves into healthcare, consumer staples, or resources before broader market recognition.

Decode the real meaning behind market movements

When news breaks, use professional broker reactions to understand the true implications. This is especially valuable during earnings season when market expectations and reality often diverge.

Position ahead of quarterly results

Monitor how professional brokers position themselves before reporting seasons in February and August. This strategy helps you spot companies where institutions expect positive surprises or are preparing to sell into results.

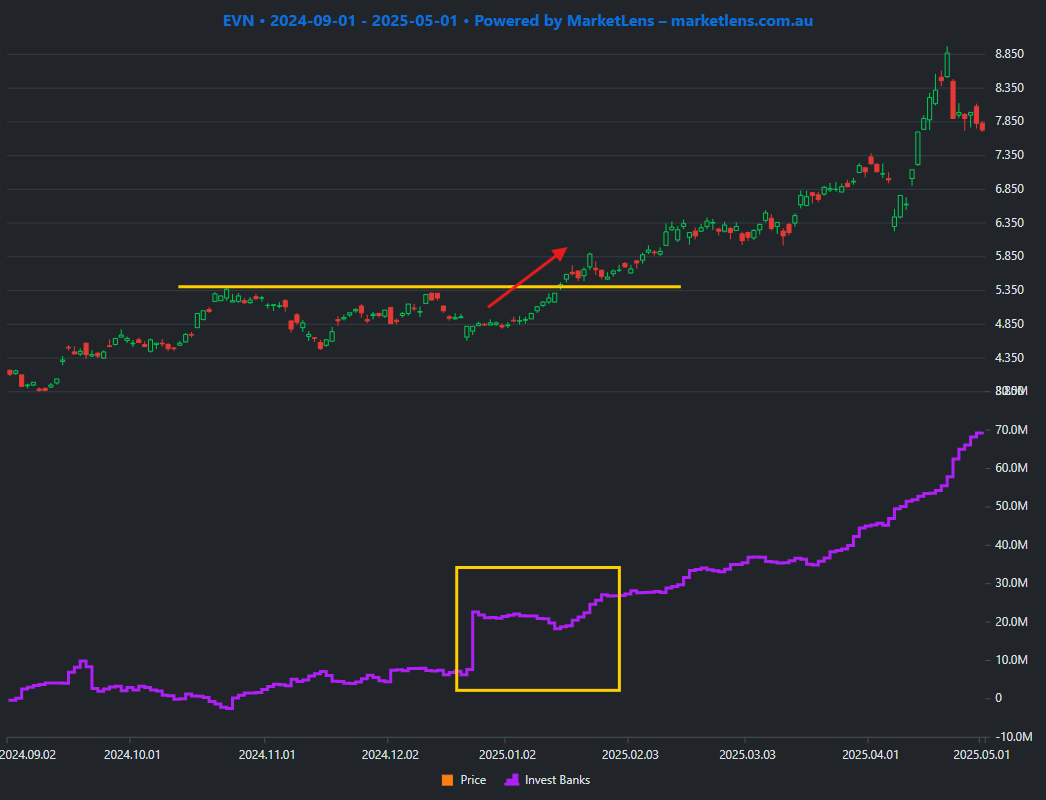

Confirm chart patterns with institutional backing

When investment banks gradually accumulate positions, they often create smooth accumulation patterns that follow technical rules. These setups have higher success rates because they're backed by informed money.

Start analyzing broker data today

Join successful ASX traders who use MarketLens to follow smart money, validate trading ideas, and discover opportunities before they become obvious to the market.

MarketLens: Your window into ASX broker data and smarter trading decisions.